Federal taxes taken out of paycheck

Federal Paycheck Quick Facts. ADP Salary Payroll Calculator.

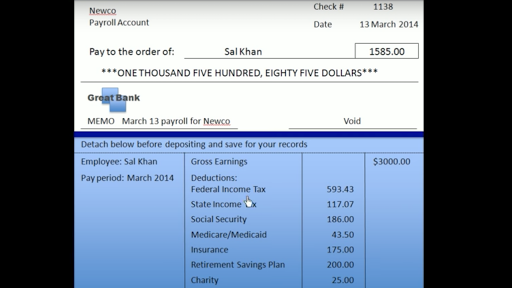

Understanding Your Paycheck

Federal income tax rates range from 10 up to a top marginal rate of 37.

. Affordable Reliable Services. How to calculate Federal Tax based on your Weekly Income. Finally if Bob requested an additional 1000 withheld from his taxes each year on his Form W-4 divide that number by 52.

You owe tax at a progressive rate depending on how much you earn. Complete a new Form W-4P Withholding Certificate for Pension or. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent.

How to calculate Federal Tax based on your Monthly Income. Ohio has a progressive income tax system with six tax brackets. Ask Your Own Tax Question Customer reply replied 1 day ago.

Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings. If youre considered an independent contractor there would be no federal tax withheld from your pay. How do I figure out how much my paycheck will be.

Ad See if you ACTUALLY Can Settle for Less. What percentage of federal taxes is taken out of paycheck for 2020. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Add your state federal state and. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and.

The result is 1108. In fact your employer would not withhold any tax at all. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Here are some calculators that will help you analyze your paycheck and determine your take-home salary. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. Median household income in 2020 was 67340.

Also What is the percentage of federal taxes taken out of a paycheck 2021. The W-4 is designed to withhold the correct amount of federal taxes based on the information you enter. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only.

Individuals who make up to 38700 fall in the 12 percent tax bracket while. For instance the first 9525 you earn each year will be taxed at a 10 federal rate. Regardless of your pay.

Your employer withholds FICA and federal income taxes from your. Total annual income - Adjustments Adjusted gross income Step 3. The federal income tax has seven tax rates for 2020.

Social Security and Medicare. Take Advantage of Fresh Start Options. In the United States the Social Security tax rate is 62 on income.

Whether youre a Huntsville Havoc or a Birmingham Barons fan youre going to get taxes taken out of your paycheck. You Dont Have to Face the IRS Alone. When you start a new job you fill out a W-4 form and the information on this form tells your employer how much to withhold in taxes from each of your paychecks.

The result is 1923 which. You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck. There are two types of payroll taxes deducted from an employees paycheck.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an. Rates range from 0 to 399. What is the percentage that is taken out of a paycheck.

How It Works Use this tool to. Step 1 - Determine your filing status Step 2. Free Confidential Consult.

Get the Help You Need from Top Tax Relief Companies. If this is the case. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

Tax withholding is the.

My First Job Or Part Time Work Department Of Taxation

Understanding Your Paycheck Youtube

Check Your Paycheck News Congressman Daniel Webster

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Irs New Tax Withholding Tables

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Calculate 2019 Federal Income Withhold Manually

Here S How Much Money You Take Home From A 75 000 Salary

Anatomy Of A Paycheck Video Paycheck Khan Academy

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Here S How Much Money You Take Home From A 75 000 Salary

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Calculator Online For Per Pay Period Create W 4

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Credit Com